Translink Corporate Finance in the United States initiated the acquisition of Electric Motor Technologies, LLC (EMT), an electromechanical service provider supporting industrial and commercial operations throughout southern Ohio, by Industrial Service Solutions, a portfolio company of Wynnchurch Capital.

Translink Corporate Finance in the United States initiated the acquisition of Webster Industries, a market leading manufacturer of engineered class chain, engineered class sprockets, and vibratory equipment for material handling and power transmission applications across diverse industrial end markets, by MPE Partners.

Translink Corporate Finance Benelux advised Batenburg Industriële Electronica on the sale to MACH Technology Group, which is a group of companies that engage in both in-house product development and manufacturing, creating innovative electronic solutions. The group is backed by investor Nordian Capital.

Translink Corporate Finance in Denmark acted as the advisor to the owners of Danish MouldShop A/S, MouldPro A/S and British MouldShop Ltd, on the sale to Groupe Baelen.

Translink Corporate Finance in the United States and Sweden advised Plastiform, Inc. and its subsidiary Precision Formed Plastics, Inc. on the sale to Nefab Group. Nefab Group, through Nefab Packaging, Inc. USA, has acquired Plastiform, Inc. and its subsidiary Precision Formed Plastics, Inc., a Texas based group specialising in high quality thermoformed cushioning solutions.

Translink Corporate Finance in Denmark advised the shareholders of ENCO VVS Service and ENCO VVS & Sprinkler, a construction company that focuses on sprinkler systems, plumbing and district heating services on the sale of the business to Kemp & Lauritzen, a large Danish installation group.

Translink Corporate Finance in the United Kingdom acted as the lead advisor to Doncaster-based Nationwide Bearing Company (NWB) on its sale to South African listed company Invicta Holdings Limited, alongside Clarion Solicitors, who acted on the deal as legal advisors to the director shareholder.

Translink Corporate Finance in Germany advised Johann Osmers GmbH & Co. KG, a renowned company in the field of plant and building technology, on the sale to HPM Die Handwerksgruppe.

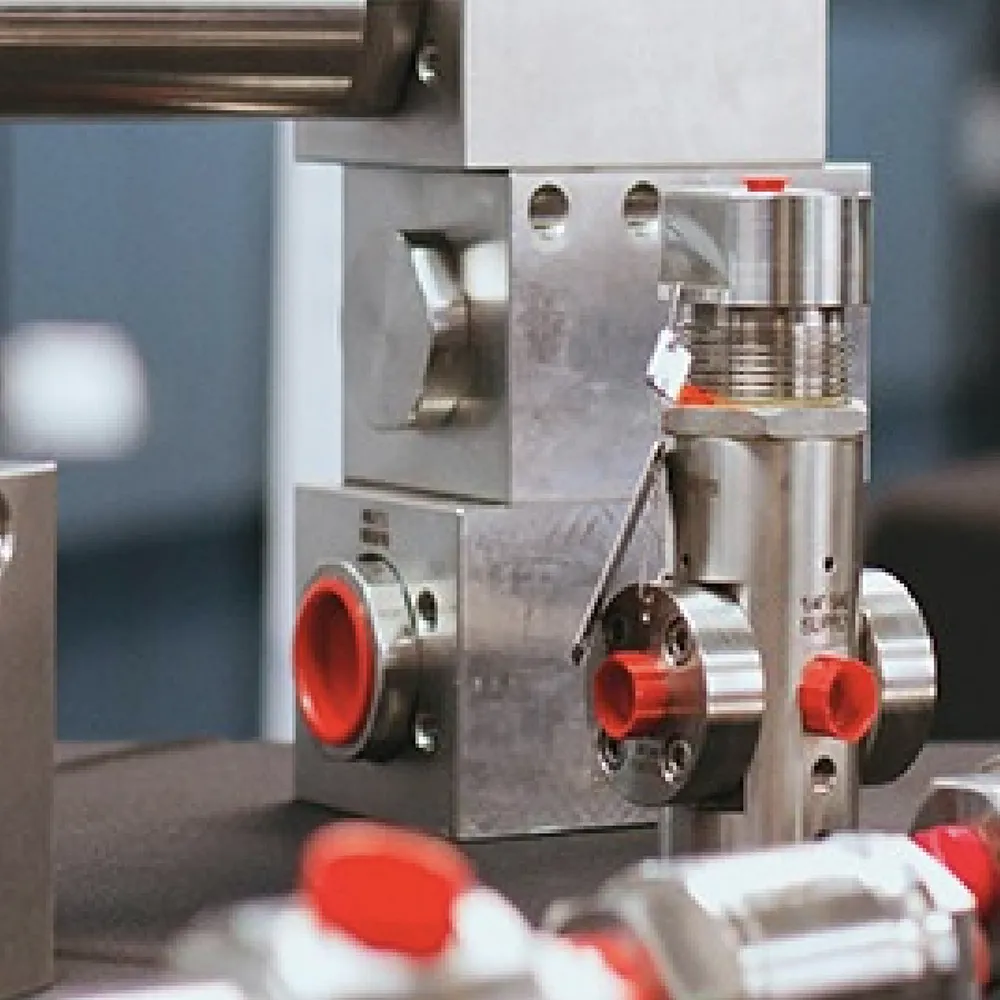

Translink Corporate Finance acted as the advisor to Control Devices, LLC, a portfolio company of HBM Holdings, in the acquisition of Gilmore

Translink Corporate Finance teams in Denmark and Sweden acted as a financial advisor to the shareholders of Ubro SystemPac A/S in the sale to OptiGroup. Ubro SystemPac A/S is a Danish packaging specialist offering packaging products and a complete range of end-of-line packaging machines.