Translink Corporate Finance in the United States advised Pilot Energy (Pilot), a leading provider of Energy Procurement Advisory services, on its acquisition of Worthington Energy Consultants (Worthington), a highly respected energy consulting group headquartered in Columbus, Ohio.

Tag Archive for: United States

Translink Corporate Finance in the United States advised COMROD Communication AS (COMROD) on the acquisition of a majority share of Triad RF Systems Inc. (Triad). The East Brunswick, New Jersey, USA company is an innovative designer and manufacturer of RF/Microwave amplifiers and integrated radio solutions for long-range RF communication in challenging environments including defence applications and aerospace systems.

Translink Corporate Finance in the US advised Lamb Insurance Services, one of Signers National’s group of premier insurance companies, on their acquisition of Ballantyne Insurance Group, a provider of insurance coverage for human service organisations.

Translink Corporate Finance in the United States and Sweden advised Plastiform, Inc. and its subsidiary Precision Formed Plastics, Inc. on the sale to Nefab Group. Nefab Group, through Nefab Packaging, Inc. USA, has acquired Plastiform, Inc. and its subsidiary Precision Formed Plastics, Inc., a Texas based group specialising in high quality thermoformed cushioning solutions.

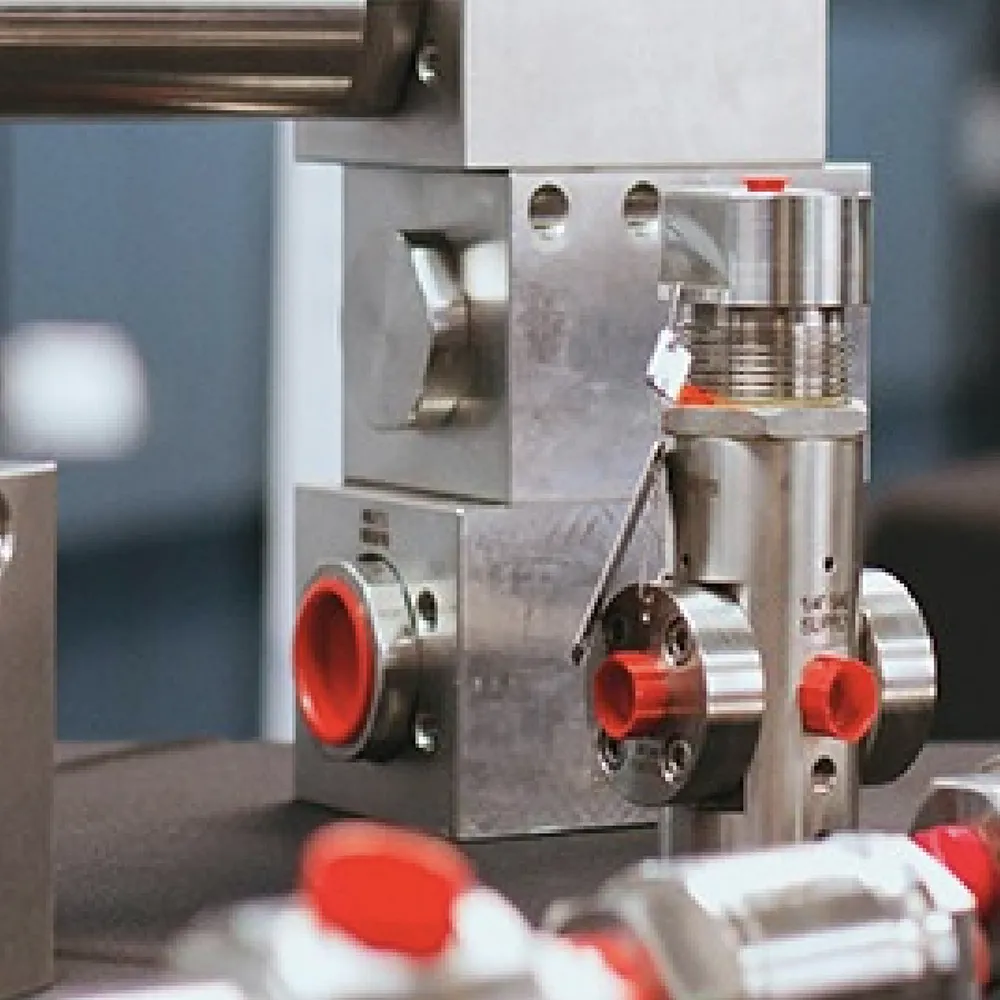

Translink Corporate Finance acted as the advisor to Control Devices, LLC, a portfolio company of HBM Holdings, in the acquisition of Gilmore

RQM+, a global leader in MedTech services, announces its acquisition of CRO Kottmann, a premier contract research organization (CRO) renowned for its excellent customer service, scientific clinical research and quality in the key market of Germany.

Translink Corporate Finance Finland served as the financial advisor to the owners of a Finnish SaaS company, AddSearch Oy, in the share purchase conducted by saas.group. AddSearch, headquartered in Helsinki, Finland, is a leading provider of hosted website search solutions.

Cross-border M&A deals are strongly influenced by timing, relationships and identifying compelling opportunities. This is the story of what culminated in December 2020, when Italian family-owned company, Pedrollo Group acquired US-based Superior Pump.

While already recognised as a world-renowned brand within the electric pump sector, exporting more than 80% of its product outside of Italy, the United States represents less than 1% of Pedrollo’s global sales.

Frontier Dental Lab Group (Frontier or FDL Group), an integrated dental lab platform, announced its partnership and investment in Friendship Dental Laboratories, LLC (Friendship), a full-service dental laboratory based in Rosedale, MD.

Translink Corporate Finance partner in the US, Dinan & Company, acted as the advisor to Mytee Product, Inc., a portfolio company of Dry Fly Capital, on the acquisition of Square Scrub.

Mytee, LLC is excited to announce it has acquired a majority stake in Square Scrub, LLC, a growing manufacturer of hard surface floor cleaning machines.