Investment from Germany to India has grown since 2021, making Germany the seventh largest direct investor.

With a rich legacy spanning over five decades, Translink Corporate Finance has established itself as a globally trusted leader in the mid-market.

A striking mergers and acquisitions (M&A) trend is set to gain momentum in 2024 – driven by the escalating cost of debt. Companies are looking to bolster their equity positions as a strategic response to the burden of high debt costs, according to Translink Corporate Finance’s ‘2024 Megatrends Report’.

The influence of environmental, social, and governance (ESG) factors is poised to reshape the mergers and acquisition (M&A) landscape in 2024, according to Translink Corporate Finance’s ‘2024 Megatrends Report’.

The influence of environmental, social, and governance (ESG) factors is poised to reshape the mergers and acquisition (M&A) landscape in 2024, according to Translink Corporate Finance’s ‘2024 Megatrends Report’.

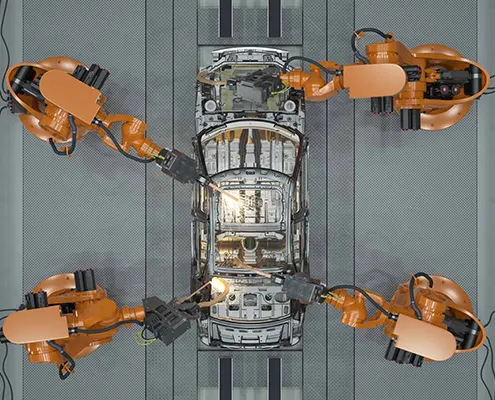

Corporations will intensify their focus on artificial intelligence (AI) and technological integration in 2024, deeming them indispensable for success, according to Translink Corporate Finance’s ‘2024 Megatrends Report’.

Cross-border deals are likely to be the first to recover in 2024, once inflation stabilises and the mergers and acquisitions (M&A) market rebounds, according to Translink Corporate Finance’s ‘2024 Megatrends Report’.

The middle-market is tipped to be the principal driver for dealmaking in the coming year, according to Translink Corporate Finance’s ‘2024 Megatrends Report’. Featuring insights from Translink partners from around the world, the report identifies six top trends that will shape the M&A landscape in 2024 and beyond.

With deep expertise in the SaaS sector, Translink Corporate Finance has helped many SaaS entrepreneurs across the globe to fund their expansion, sell their business or even acquire news ones.

Cross-border merger and acquisition (M&A) dealmaking continues to gain traction, with India representing a compelling investment opportunity for German companies. The country recorded 194 deals in Q1 2023, at an aggregate deal value of US$19.6 billion, driven by a unique combination of market size, market potential, and talent pool.