Translink Corporate Finance announces the sale of Groupe Barbarie, a French manufacturer of wooden packaging (pallets and palox). Translink acted as the exclusive financial adviser to Groupe Barbarie.

Translink served as exclusive M&A advisor to Craig & Derricott Holdings Limited on its sale to Addtech Power Solutions, a business area of Addtech AB (publ).

In a significant move to expand their distribution offering, Adcock Ingram Healthcare (Pty) Ltd, has acquired Virtual Logistics (Pty) Ltd, a national and cross border fine distribution company. Translink acted as advisor to the buyer. The acquisition will be effective April 2017.

Göttelborn, Germany. Nanogate AG, a leading global specialist in design-oriented, high-tech surfaces and components, has completed its acquisition of around 80 percent of US plastics specialist, Jay Plastics, as planned. Dinan Capital Advisors, Translink affiliate in the US, served as financial advisor to the buyer.

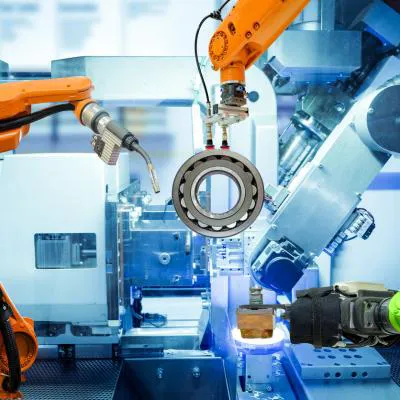

Translink Corporate Finance announces the acquisition of DMG meccanica, a leading machinery and plant manufacturer for electric motors.

Translink advises Sperre Group on its sale of 66% of the shares in Sperre AS to AKVA Group ASA

Translink Corporate Finance announces Sperre Group’s sale of Sperre AS to Akva Group.stems Specialist headquartered in London with offices in Finland and Denmark, to Convergint, a global leader in service based systems integration. Translink acted as the exclusive financial adviser to the shareholders of Universal Security Systems.

Iberia Industry Capital Group acquired the German subsidiary of EuroMaint AB

Translink Corporate Finance announces the acquisition of “EuroMaint Rail GmbH”, a maintenance service contractor for rolling stock, by “Iberia Industry Capital Group”.

Translink Corporate Finance announces the acquisition of a majority shareholding in Callius GmbH, a logistics company specialized on tailored logistics and fulfilment-concepts, by the French company STACI, a leading provider of logistic services. Translink acted as the exclusive financial advisor to the buyer.

Alucol Group, founded in 1971 and active in anodising and colouring of aluminum profiles and sheet metal, is acquired by the BWB Group, specialized in electrolytic, chemical and galvanic surface treatments.

Translink Corporate Finance announces the acquisition of Metal Concentrators (Pty) Ltd, the second largest South African refiner of precious metals, by Caxal Enterprises (Pty) Ltd, the investment holding vehicle for the Crosse family. Translink acted as the exclusive financial adviser for Caxal Enterprises.