Translink Corporate Finance announces of the acquisition by Exodraft A/S of 60% of the shares in Dansk Energi Service A/S. Schrøder TRANSLINK, Denmark, served as advisor to the acquirer. Exodraft A/S is a world’s leading supplier of mechanical chimney exhaust solutions for industrial and residential clients as well as solutions for industrial heat recovery. Exodraft also supplies electro-static filters for the removal of flue smoke particles.

Since 2005, Kiwa has been delivering product certification and agro-food inspections in China. By allying with BCC Inc. with more than 600 employees active in management system certification in China, Kiwa strengthens its platform in China through which various additional activities can be launched. While also obtaining the ownership of 50% in SNQA, a JV of BCC and NQA, Kiwa expands its TIC services to the automotive sector in several Asian-Pacific countries as well.

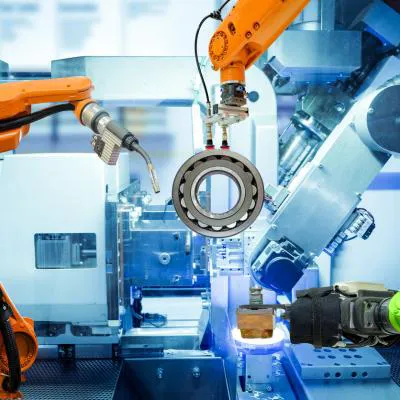

Goldner Hawn, LP (“Golder Hawn”) announced that it has partnered with management to recapitalize Concept Machine Tool Sales, Inc. (“Concept” or the “Company”), a leading value-added distributor and service provider for advanced machining, automation and measuring equipment in the upper Midwest. Translink acted as advisor to Goldner Hawn.

Windcorp Translink, member of Translink Corporate Finance is pleased to announce that they have served as exclusive M&A advisor to OMB Self Storage S.L. shareholders’ in the sale of a 100% stake to Safestore Holdings. The transaction is valued at EUR17.25m.

Windcorp Translink, member of Translink Corporate Finance is pleased to announce that they have served as exclusive M&A advisor to Masvoz Activa Global, S.L. shareholders’ in the sale of a 100% stake to Enreach Group.

Masvoz, founded in 2002, provides telecommunication platforms and services for businesses, including VoIP (voice over internet protocol) and cloud communications, an area in which it has an extensive catalogue and has become a market reference.

Translink Corporate Finance acted as the exclusive financial advisor to the shareholders of FEW. The transaction team comprised Andreas Hüchting (Partner), Dennis Magath (Director) and Mareike Maas (Associate).

Translink UK firm BHP Corporate Finance are delighted to have acted as lead advisor to Check Safety First Limited (“CSF”), a leading global hospitality assurance business, on its significant acquisition by Intertek Group plc, the FTSE100 Total Quality Assurance specialist, headquartered in London.

NEW YORK — Alleghany Capital Corporation (“Alleghany Capital”), a wholly-owned subsidiary of Alleghany Corporation, today announced the formation of Precision Cutting Technologies, Inc. (“Precision Cutting Technologies”) and the acquisition by Precision Cutting Technologies of a majority interest in Coastal Industrial Distributors, LLC, dba CID Performance Tooling (“CID”).

CID Capital is proud to announce that it has partnered with Seaga Manufacturing. Headquartered in Freeport, Illinois, Seaga is a leading manufacturer of intelligent food/beverage and industrial vending equipment sold across multiple end markets.

Translink Corporate Finance announces the acquisition of Move Elevator GmbH & Co. KG, a leading player in the space of complex POS logistics, by French company Staci, a European specialist in picking and fulfilment since 1989.