Strong investor interest holds – but a more selective, value-conscious market emerges

The latest Translink Corporate Finance (TranslinkCF) SaaS Valuation Index shows that after a period of sustained growth, Q1 2025 marked a turning point for the SaaS sector. Amid persistent global economic uncertainty and investor caution, SaaS deal volumes showed a slight contraction – down 2.4% from Q4 2024 – yet the market remains highly active, with deal volumes still well above historical averages. Our Index reveals a more selective investment environment, where fundamentals matter more than ever, and premiums are increasingly reserved for companies with strong financial health, vertical specialisation, and clear future growth pathways.

Key Findings

Deal activity: Still high, but down slightly

After a record 2024, with over 6 700 SaaS deals completed globally, Q1 2025 showed a modest pullback in volumes – down 2.4% quarter-on-quarter to 1 576 deals. This compares with 1 615 in Q4 2024. While the decline is notable, volumes remain significantly above the long-term average of around 1 200 deals per quarter, underscoring ongoing appetite for SaaS assets.

Interestingly, regional dynamics have shifted. The United States has regained the lead from Europe in terms of deal momentum. This reflects not only continued domestic demand, but also a slower quarter for Europe, where cautious sentiment appears to be dragging on M&A activity.

Valuations hold – But underlying dispersion grows

- The median NTM revenue multiple declined to 3.3x in Q1 2025 (from 3.6x in Q1 2024).

- While headline multiples appear stable, they mask a wide valuation range: premium valuations persist for outperformers, but underperformance is being penalised more harshly.

- Investors are applying greater scrutiny, with growing divergence between high-growth, high-efficiency companies and those with lagging fundamentals.

Growth expectations are more muted

- Only 20% of companies in the Index recorded YoY growth exceeding 20%.

- The median revenue growth rate across the sample sits at a modest 10%, signaling caution on top-line expansion.

- Among the top performers, median NTM EBITDA margins remain healthy at 51.7%, with growth expected at +25.6%, although this is lower than in Q4 2024.

Rule of 40 becomes a key differentiator

In previous quarters, SaaS companies with a Rule of 40 score above 60 consistently commanded a strong valuation premium – and while that trend continued in Q1 2025, the premium narrowed. The quarter was characterised by a broader market slowdown, making it harder to draw definitive conclusions. Outperformers were notably fewer, and those that did stand out were underpinned by solid fundamentals, with a median NTM EBITDA margin of 51.7% and growth forecasts of 25.6% – slightly below Q4 levels. These top-tier firms are successfully attracting investor interest by doubling down on strategic clarity, operational reliability, and a compelling long-term growth narrative.

Regional valuation trends

- USA: Despite economic uncertainty, valuations held relatively firm at 3.5x NTM revenues, though this marks a record low. The SaaS Capital Index showed greater volatility, suggesting smaller-cap players may be more vulnerable.

- Europe: Continued deal activity was accompanied by a further valuation decline to 3.0x, pointing to persistent investor conservatism.

- Rest of World (RoW): Valuations increased to 3.6x, the highest level in a year – potentially driven by shifting global trade dynamics and investor interest in emerging markets.

About the Index: A benchmark for private mid-market SaaS

The TranslinkCF SaaS Valuation Index tracks 154 listed SaaS companies across the US, Europe, and RoW, with a strong emphasis on the private mid-market segment. Uniquely, 58% of the sample comprises small-to-mid-cap B2B SaaS companies based in Europe, providing an ideal benchmark for valuation trends among the types of businesses most active in cross-border M&A.

Over a third of these companies generate less than €50 million in revenue, and nearly 70% fall below the €250 million mark, making this a highly relevant dataset for founders, investors, and advisors navigating the mid-market.

SaaS is still in play – but discipline is back

Q1 2025 confirmed that SaaS remains one of the most active sectors globally – but it also showed that the rules of the game are evolving. The exuberance of previous years is giving way to a more disciplined, fundamentals – driven investment environment. Buyers are becoming more selective. Valuations are no longer propped up by growth alone. And companies that fail to demonstrate profitability and a compelling strategic vision are increasingly falling behind.

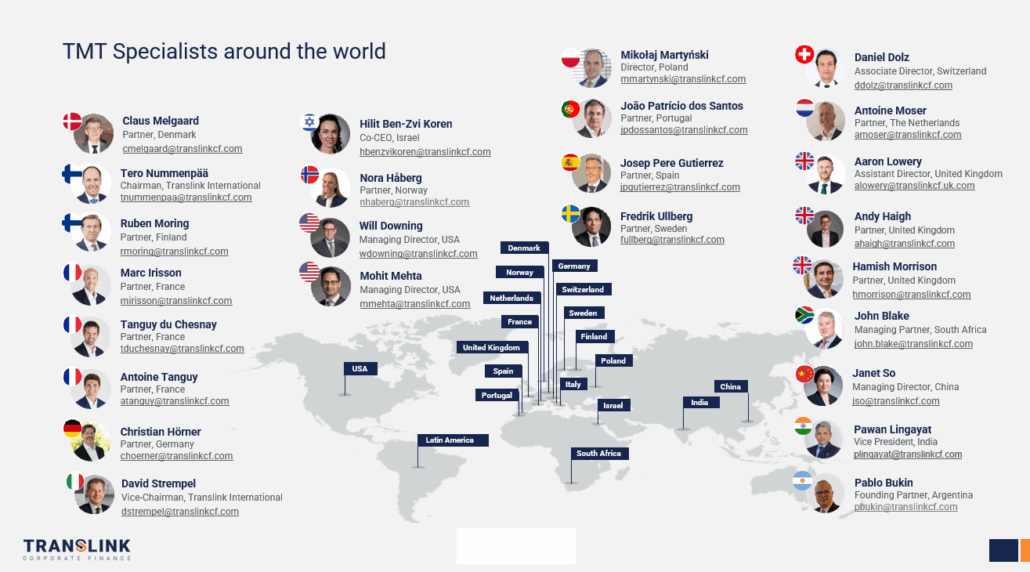

At TranslinkCF, we help SaaS businesses navigate this shift. With deep expertise in the sector, a global footprint across 35+ countries, and a sharp focus on private, mid-market deals, our team is ideally positioned to guide founders, boards, and investors through strategic decisions – whether it’s fundraising, acquisition, or exit.

Ready to explore your next move in SaaS? Connect with our global team at www.translinkcf.com and tap into the valuation insights, network, and execution strength that TranslinkCF delivers.